Joyce urges residents to drive sober this Fourth of July weekend

- Details

- Category: Press Releases

KANKAKEE – With Independence Day right around the corner, State Senator Patrick Joyce is joining law enforcement officials in reminding people to celebrate safely and drive sober.

KANKAKEE – With Independence Day right around the corner, State Senator Patrick Joyce is joining law enforcement officials in reminding people to celebrate safely and drive sober.

“Impaired driving is 100 percent preventable,” said Joyce (D-Essex). “I want folks to enjoy their Independence Day festivities, but remember that alcohol not only hinders your ability to drive, but also affects your judgment about whether you can or should drive.”

The Illinois Department of Transportation launched a multimedia safety campaign – “It’s Not a Game” – that drives home the message there are no extra lives, no respawns and no second chances to get it right when you are behind the wheel.

Last year in Illinois during the July Fourth holiday period from July 2-5, there were 22 car wreck fatalities, which is the highest total in the last five years. Officials are urging residents to plan ahead to prevent a tragedy.

“Illinois State Police Troopers will be out in full force over the holiday weekend looking for impaired drivers,” said Illinois State Police Director Brendan F. Kelly. “Driving while impaired due to alcohol or drugs can be a costly decision that puts your life and the lives of other people on the road in danger. Be responsible this Fourth of July and don’t lose your independence by losing your license or your freedom by going to jail.”

The Fourth of July “It’s Not a Game” campaign is made possible by federal traffic safety funds administered by the Illinois Department of Transportation.

Joyce-supported measure to help emergency dispatchers signed into law

- Details

- Category: Press Releases

SPRINGFIELD – Emergency dispatchers will now have access to many of the same services and benefits as other first responders thanks to legislation signed into law with support from State Senator Patrick Joyce.

“Emergency medical dispatchers are the first point of contact to gather clues and cues about an emergency,” said Joyce (D-Essex). “This new law recognizes these folks in the important role that they play during a crisis.”

The new law updates existing state statute to include “emergency medical dispatchers” as first responders, enabling them to receive many of the same services and benefits. The new law also recognizes not only the role that dispatchers play, but the fact that many of them face the same issues as other responders, including post-traumatic stress disorders and other issues.

Read more: Joyce-supported measure to help emergency dispatchers signed into law

Joyce offers prizes to participants in Summer Book Club

- Details

- Category: Press Releases

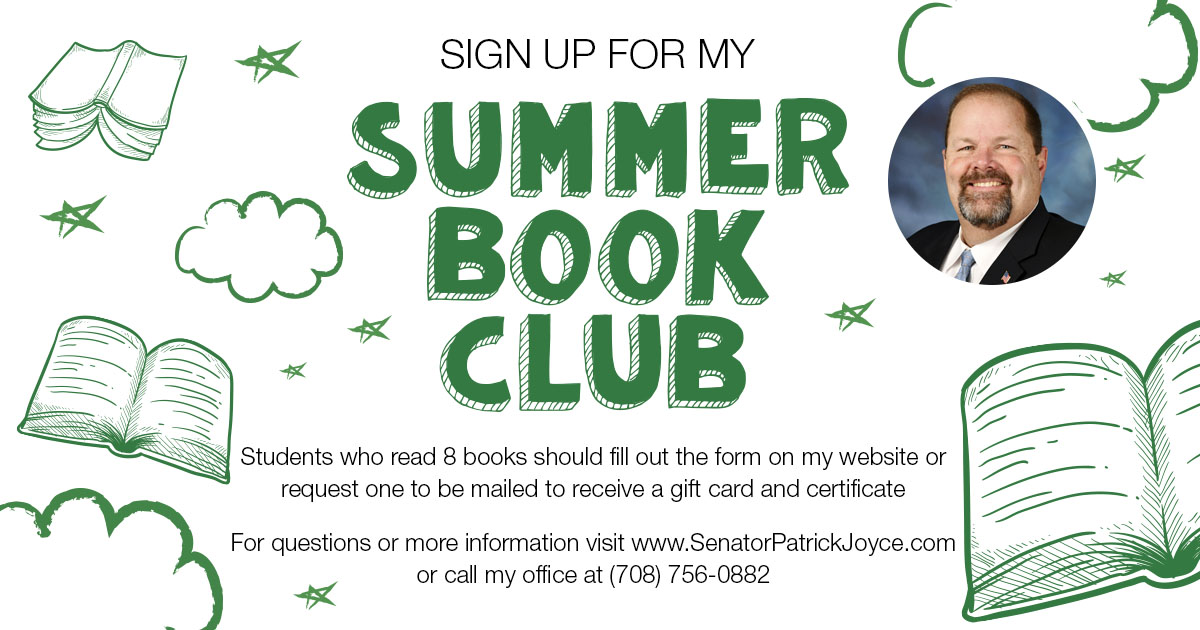

KANKAKEE – To encourage young people to continue learning this summer, State Senator Patrick Joyce is reminding parents to sign up their children for his Summer Book Club for students who live in the 40th State Senate District.

“Keeping your mind active with reading makes your brain stronger,” said Joyce (D-Essex). “I hope that kids of all ages will take advantage of this opportunity and be rewarded for their hard work.”

The Summer Book Club requires students to read eight books of their choice during the summer break, record the names of the books on a form and return the form to Joyce’s office by Aug. 11. Everyone who completes the Summer Book Club will receive a gift card and certificate from Senator Joyce.

Read more: Joyce offers prizes to participants in Summer Book Club

More Articles …

Page 37 of 104