- Details

- Category: Information

PARK FOREST – In an effort to provide financial and technical support to the dairy industry in Illinois, State Senator Patrick Joyce (D-Essex) is urging dairy farmers and businesses apply for grants through the Dairy Business Innovation Alliance (DBIA).

“Every dairy farmer should look at this grant opportunity,” Joyce, a member of the Senate Agriculture Committee said. “These grants are designed to help dairy producers and processors expand, while promoting more entrepreneurial efforts.”

DBIA, a joint effort coordinated by the Center for Dairy Research and the Wisconsin Cheese Makers Association, was designed to support and promote the diversification and addition of value-added products to the Midwest dairy industry.

Goals of the program include increasing on-farm diversification, creating value-added dairy products like specialty cheeses, and expanding export opportunities for farm-scale and processor dairy products.

The grant application period is now open. A total of $220,000 in funds is available, with individual projects eligible for up to $20,000 each. The deadline to complete and return applications is Aug. 14. Selected producers and business owners will be notified Sept. 4.

For questions or additional information, call DBIA at 608-265-1491 or visit https://turbo.cdr.wisc.edu/dairy-business-innovation-alliance/.

- Details

- Category: Information

PARK FOREST — With pandemic-related stress weighing heavily on many Illinoisans, State Senator Patrick Joyce (D-Essex) is encouraging residents to explore to the Illinois Department of Human Services’ new mental health programs.

PARK FOREST — With pandemic-related stress weighing heavily on many Illinoisans, State Senator Patrick Joyce (D-Essex) is encouraging residents to explore to the Illinois Department of Human Services’ new mental health programs.

“The additional stressors people are facing caused by the pandemic can be difficult to navigate with the uncertainty around us,” Joyce said. “Pandemic or not, we need to focus on people’s mental health, and these new programs will ensure there are resources available for those in need.”

IDHS introduced three new programs Monday to help Illinoisans struggling with mental health, developed in coordination with community mental health centers and nontraditional service providers across the state.

The first new program, the Living Room Program, is designed specifically for those in need of a crisis respite program to divert crises and break the cycle of psychiatric hospitalization. It provides a safe, inviting, home-like atmosphere where people can calmly process a crisis event while learning how to avoid a future crisis.

The Transitional Living Centers Program is a housing resource for people with mental illnesses who are in need of a place to stay while they work to find permanent housing.

Additionally, the Transitional Community Care and Support Programs offer assistance to current patients of state-operated psychiatric hospitals who are preparing to be discharged. It will include funding for non-traditional supports, such as cell phones, food, clothing, transportation and other resources that are necessary for individuals to succeed as they transition back into communities.

Individuals seeking help from the Living Room Program may be referred by first responders or medical professionals. Participants of the other two programs will be referred by IDHS and other providers. Anyone who thinks they may benefit from these programs should talk to their mental health provider.

For more information and to find additional mental health resources, click here.

- Details

- Category: Information

PARK FOREST – As many parents return to the office after months of working from home, State Senator Patrick Joyce (D-Essex) is encouraging child care providers to take advantage of the $270 million Child Care Restoration Grant program.

“Parents need to know their children are in a safe and healthy environment as more workplaces reopen,” Joyce said. “Child care providers have been hit especially hard by the coronavirus pandemic, and eligible providers should take advantage of this grant so they can safely reopen their doors.”

The Illinois Department of Human Services is distributing $270 million in available funding to assist child care providers across the state with reopening in the wake of the COVID-19 pandemic. Licensed child care providers that meet the eligibility criteria may apply for Child Care Restoration Grants.

To be eligible for the grant, child care providers must:

- Have a current license from the Department of Children and Family Services to care for children,

- Be open and caring for children at the time of application,

- Be able to demonstrate a “business interruption” from their pre-COVID capacity, and

- Submit a complete application with all required documents.

Applications are open until Aug. 14. To learn more and apply, child care providers should visit www.inccrra.org/.

- Details

- Category: Information

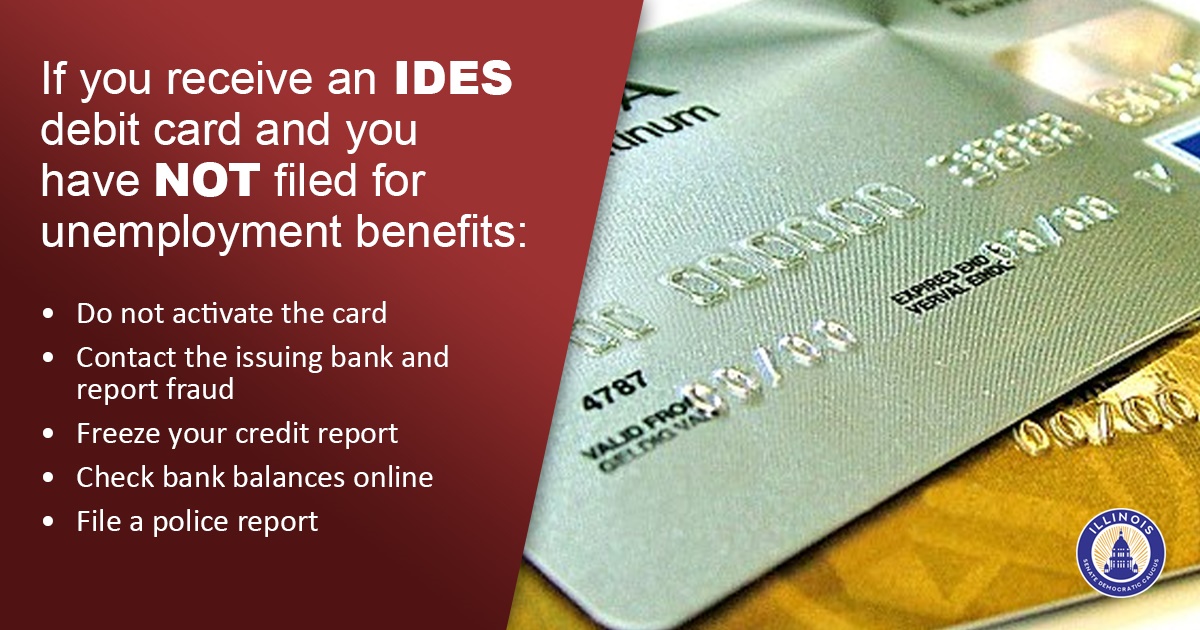

PARK FOREST – In an effort to combat pandemic-related scams, State Senator Patrick Joyce (D-Essex) is urging residents to look out for potential unemployment fraud.

Some Illinoisans have reported receiving a KeyBank debit card and an unemployment letter from the Illinois Department of Employment Security (IDES) despite never having applied for unemployment.

“If you get a notice of unemployment benefits in your name even though you haven’t filed, notify the authorities immediately,” Joyce said. “Your personal information could be at risk—if you believe you could be a victim of fraud, act now to spot and stop scammers.”

IDES confirmed individuals who have not filed for benefits but received a debit card or unemployment letter could be the target of fraud. Anyone who has received a debit card without filing is encouraged to contact their local police department and report the incident with IDES.

More Articles …

Page 8 of 15